How does the cryptocurrency market and its wild price swings affect other asset classes and the broader economy?

By Nigel Bowen

Not so long ago, it seemed like crypto had finally been accepted as a volatile but bona fide asset class.

Prominent sceptics, such as Ray Dalio, had changed their tune. Millennials despairing of ever getting a foot on the property ladder were fantasising about getting rich quick by buying low and – within months, weeks or days – selling high.

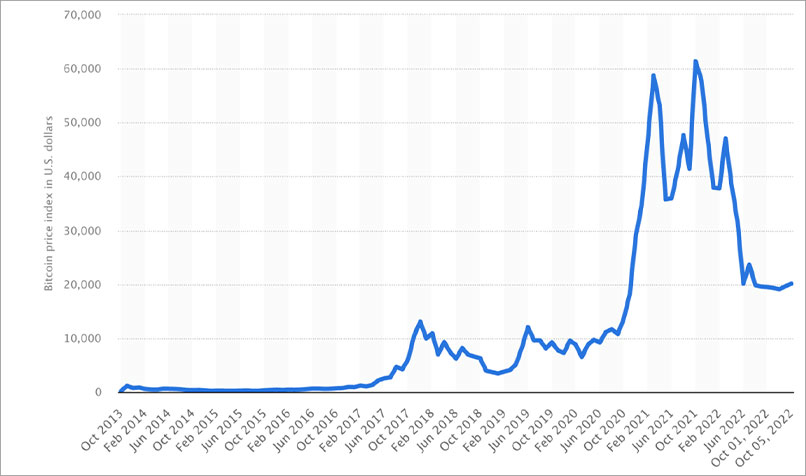

In mid-November 2021, a single Bitcoin would set you back more than US$68,000 (A$107,500, given the current exchange rate).

Then, as is its habit, Bitcoin crashed.

“Crypto Winter” descended and wiped US$2 trillion (A$1.54 trillion) off the value of the crypto market. At the time of writing, it’s unclear whether “Crypto Summer” will ever arrive.

It’s also unclear whether crypto will continue its journey to mainstream respectability and become correlated to other asset classes.

Bitcoin (BTC) price per day from October 2013 to October 20, 2022 (in U.S. dollars)

A brief history of Bitcoin

Bitcoin first started being used for online transactions in 2011. However, it didn’t begin to cross over into the mainstream and start skyrocketing in value until 2017.

That’s when a sizeable number of retail investors started investing in cryptocurrencies. This was also when speculation began to mount about Bitcoin becoming correlated with other asset classes, particularly shares and gold.

Bitcoin started heading skyward again when, thanks to lockdowns, many people found themselves with time on their hands and government payments in their bank accounts.

While remaining volatile, the price of Bitcoin hit historic highs from late 2021 to early 2022, and then began a steep decline.

To read more of this article, see it at INTHEBLACK